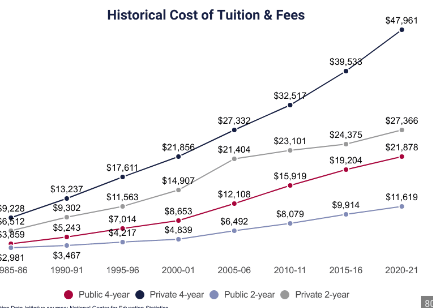

When it comes down to deciding where you want to spend the next four years of your life, typically there are three major factors to consider: location, academics, and cost. Over the past ten years, we have seen college tuition prices tremendously increase.

Berit Campbell, a senior, has stated to me, “Tuition is insane. I don’t know how colleges expect my parents and me to pay for that. I got into schools that were charging me $90,000, which is insane to think anyone can afford that for four years.”

The amount of debt students graduate from college with nowadays is ridiculous. My sister, who is attending Depaul, got her tuition way down and is still going to be in lots of debt fresh out of college. Even students who qualify for in-state tuition are paying around $20,000–$30,000 to attend college, which, if you are financing your own education, will put you in debt. Not to mention, the Fafsa is no longer helpful to low-income families. Students can now only receive up to around $7,000 in grants from the government. With schools charging excessive prices, that won’t even make a dent in the total cost. Bella Mathys, another senior, told me, “Tuition prices are disappointing, especially since the Fafsa isn’t helping kids as much. Something needs to change.”

My best advice to upcoming seniors is to do your research. Private colleges tend to give out bigger merit and financial aid scholarships, so if you plan on going out of state, private colleges are going to be your best bet. Big state schools tend to give little to nothing in aid. Also, use net-price calculators. Generally, they’re not super far off and will give you a good idea of how much it will cost to go to the school. Although the net price calculator is telling you the net cost is near $10,000–$20,000 for an out-of-state college, it is not true. Most likely, you will end up paying near the full tuition price, which is a sad truth and very misleading.

Another very important thing you can do to lower a college’s cost is to negotiate. If you are a good student or have new information that could change your financial aid package, the majority of the time they will meet your demands. If you got a really fantastic scholarship from another school, use that as leverage. Even if they don’t meet your demands, it’s possible they will give you a couple more thousand dollars in aid. A win is a win. Best of luck to the class of ‘25! Start having discussions with your parents and drawing up plans on how to afford college these days. You don’t want to be in debt.